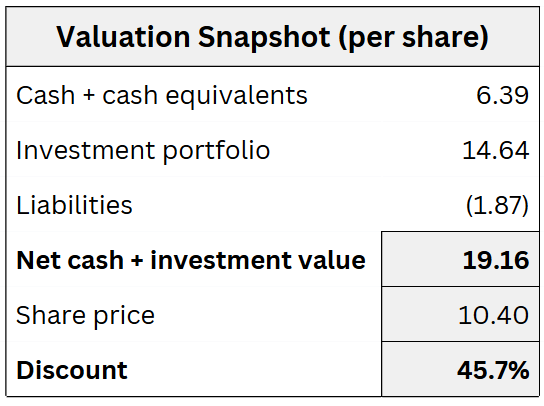

Overlooked Microcap Trading 45% Below Net Cash and Investments

Pay 54 Cents on the Dollar and Get the Operating Business for Free

Key Metrics:

Trades ~45% below net cash and investments

Actively returning cash to shareholders

No investor coverage or existing write-ups

I rarely do regular screening.

Sometimes I do. But most of the time, I keep things very simple.

I only set a few loose filters, like no extreme debt or obvious red flags, just to make sure nothing is completely out of control. Then I go through the list one by one. Sometimes even entire exchanges at a time.

Most of the companies are nothing you’d ever want to put money into. You can skip them very quickly, often in under a minute.

But every now and then, you find something interesting.

What usually helps is curiosity. Many small stocks do not have clean data on screening platforms. Sometimes there are no recent financials at all. Then you have to go to the company’s website, open the investor relations section (if it exists), and read the reports yourself. And sometimes, that’s exactly how you find things nobody else is looking at.

If you do this regularly, maybe an hour in the evening, just flipping through stocks and letting curiosity guide you, you will stumble across things. Quite often, they are companies you have never heard of before.

That is exactly how today’s stock found me.

I was doing my usual ticker flipping when it jumped out at me. It is a small business. But what makes it stand out is not the operating company itself. It is the size of its investment portfolio and its cash position.

The company owns a large portfolio of mostly blue-chip stocks. Together with its net cash, these assets are almost twice as large as the company’s market value.

Below is a simple valuation snapshot on a per-share basis.

In other words, the market is valuing the company’s portfolio and net cash at only about 54 cents on the dollar. And the profitable operating business comes on top, for free.

It’s somewhat similar to Buffett’s Sanborn Map investment.

Let’s take a closer look.