Two Hidden Gems from the OTC Market

Two time-tested businesses trading at 50 cents on the dollar.

Both of today’s stocks trade on the OTC market. A little, overlooked corner of the stock market where the rules are a bit looser, but the chances of finding anomalies are often better.

You’ll often come across dusty old businesses from the 60s, regional banks with 100-year histories, or small family-run companies that never uplisted. Since most big funds don’t bother with OTC stocks, there’s quite the chance for the ambitious investor to find some undervalued opportunities.

Of course, there’s also a fair share of garbage on there. So you’ll need to do a lot of filtering and searching to find some profitable, cash-flowing, dividend-paying old-school business. But if you’re a little patient and picky, I have no doubt you’ll come across something interesting.

Sadly for us, the number of quality OTC stocks is shrinking. Many businesses have realized they can achieve much higher valuations trading privately. But from an investor’s perspective, that’s exactly what you want: businesses trading at prices you wouldn’t even get in a private deal or small acquisition. That’s the magic of Mr. Market.

Anyway, as I said, both of today’s stocks trade on the OTC market. Both are older businesses, growing at a healthy rate, profitable, and dividend-paying.

I should say, I don’t think they’ll 1000x in a year or ride the next AI wave. But I do think they’re trading at 50–60 cents on the dollar and represent classic value opportunities in the old-school Buffett & Graham style.

I hope you enjoy the read.

McRae Industries

McRae Industries ($MCRAA) makes Boots. Different kinds of boots. From classic Western styles with fancy tooled leather to tough work boots and full-on combat boots for the U.S. military.

The company has a market cap of $105 million and an enterprise value of just $63.5 million. They have been around since 1959 and are based in Mt. Gilead, North Carolina, about 90 minutes from Charlotte.

McRae has remained consistently profitable, with no net or operating losses since 2015, except for 2020. They also have a habit of paying out special dividends when they sell off real estate or other assets. They make good money. They just don’t always use it that efficiently. More on that later.

Ownership

Since McRae trades on the OTC, it no longer files financial statements with the SEC. In fact, the company stopped filing back in 2005 to reduce costs. However, McRae still publishes audited financials each year, with Grant Thornton serving as auditor for over a decade.

Because of that decision, we also no longer get up-to-date ownership data. The last available numbers are from 2005, when the McRae family owned about 40% of the Class A shares, 60% of the Class B shares, and controlled roughly 53% of all voting power.

The company also stopped disclosing executive compensation. Back then, Gary McRae (President) was making around $250K, and the full executive team earned a combined $800K. It's safe to assume those numbers have gone up with profits, but there’s no public data to confirm that.

In short: This is not an institutionally held business. The majority of shares are still in private hands, and the McRae family remains in control.

The Numbers

When I go through the numbers of a business, I usually start with their annual report.

Funny enough, the first thing that stood out to me in McRae’s most recent report wasn’t some specific financial metric. It was the cover. (Who would’ve thought?)

Unlike the usual plain-text-in-Arial-on-a-white-background setup you see with most small businesses, McRae put some real effort into the design. So it stood out quite a bit.

Here’s a screenshot:

Income Statement

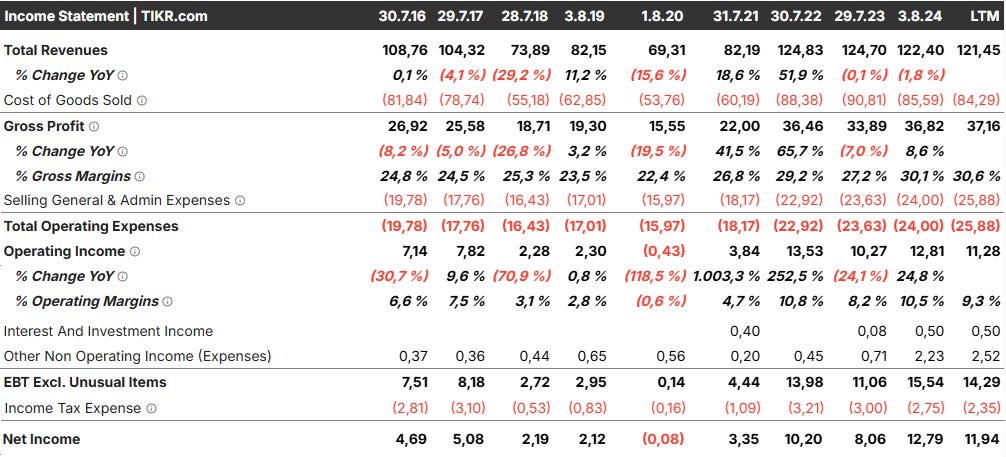

Revenue has been growing steadily since the COVID dip, with a bit of stagnation more recently. But that flattening is something seen across the entire industry.

Gross margins have been slowly but consistently improving. Same goes for operating margins, although those, too, have stagnated a bit since 2022.

Net income has improved every year since their small net loss in 2020 and is now significantly above pre-COVID levels. In 2024, they reached a record profit of $12.79 million.

What’s interesting in their income statement is the $0.5 million they make in investment income and the additional earnings booked under "Other Non-Operating Income."

These numbers are mostly a result of their real estate portfolio, from which they earn steady interest and occasional profits from asset sales.

McRae Industries holds investment properties primarily in Berkeley County, South Carolina. These aren’t used for operations; they’re strictly held as investments.

Personally, I’m not a fan of that part of the business. I get it, but I don’t like it.

The company generates more than enough profit from boots alone, yet instead of returning excess cash to shareholders, management either lets it pile up on the balance sheet or uses it to buy real estate.

Even if they used it for well-thought-out acquisitions, that would be better than letting it sit idle (although, to be fair, most acquisitions destroy value, and companies with aggressive M&A strategies are usually better avoided).

Still, I doubt they’re able to outperform professional real estate investors, whether that’s REITs or specialized private funds, who focus full-time on this space. It’s unlikely that you can run a $100 million boot business and beat full-time real estate pros on the side.

They highlight the impact of these investments themselves:

„This increase in net earnings is primarily the result of a decrease in our western/lifestyle products offset by an increase in our military boot operation, land sales, and investment income.“

Currently, they pay a modest dividend of $0.56 per share and occasionally issue special dividends when they sell real estate.

Balance Sheet

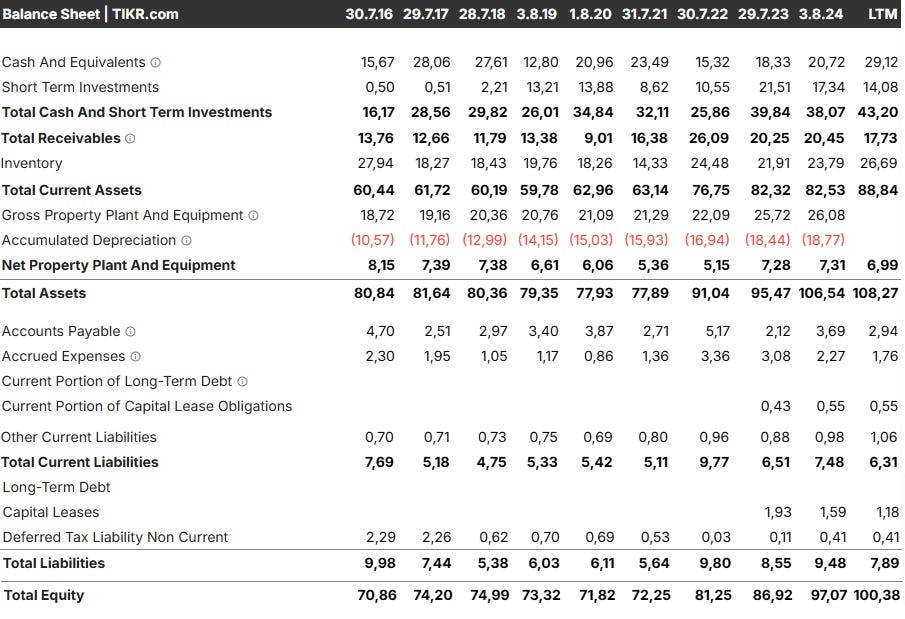

Their balance sheet is in pristine condition.

Aside from a small $1.2 million capital lease, their balance sheet has not been disturbed by anyone. Kind of like an untouched fresh ski slope in the early morning.

They hold $43.2 million in cash and investments, and, again, aside from the small lease, the company is completely debt-free.

That gives the business a lot of strength and makes the risk of insolvency practically zero.

But it also highlights their inefficiency when it comes to capital allocation. There’s plenty of unused value just sitting there.

Revenue Breakdown

I want to take a moment to go into a bit more detail on how McRae’s revenue is split between segments.

While most of their business still comes from Western and work boots, there have been some interesting developments in their military segment that could create real value going forward.

(If you’re not interested in the weeds here, feel free to skip to the valuation part.)

As mentioned earlier, part of McRae’s business is manufacturing military boots and selling them to the U.S. government. It’s not their biggest segment and historically hasn’t been the main earnings driver. Still, it’s far from irrelevant.

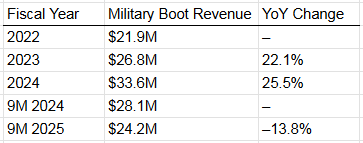

In 2024, the military segment brought in $33.6 million, about 27% of total revenue.

„Sales to the U.S. Government amounted to 23%, 18%, and 12%, of total consolidated net revenues for fiscal years ended 2024, 2023, and 2022, respectively.“

If you're wondering why I said 27% while the company stated 23%, that's because they’re now also selling military boots to foreign governments and non-governmental security agencies or special forces.

„We also have a contract with a foreign government for military combat boots and are working hard to increase our commercial military boot sales.“

So while this business has shown a clear, albeit volatile, growth trend in recent years, with a notable improvement in profitability in 2024, things have started to soften again in 2025.

„While we currently have contracts for four different boots with the United States Government, their demand for military boots is not as robust as it has been in previous years. This can have a negative impact on our manufacturing efficiency and cost.“

That slowdown is the main reason why total revenue and earnings for the last twelve months (LTM) are down compared to fiscal year 2024.

Here’s how revenue in the military segment evolved in recent years:

Until 2024, the segment was actually unprofitable, mainly because the old contracts with the U.S. government had been signed before inflation spiked, at prices that no longer reflected the real cost environment.

That changed in April 2024, when McRae received a new large order from the U.S. Marine Corps, this time at more market-adjusted terms. Together with production efficiency gains, this helped make the military segment profitable for the first time in years.

I also found it very promising that McRae is now actively working to increase foreign government contracts and commercial military boot sales.

That makes sense for several reasons:

Diversification

Right now, they’re heavily dependent on the U.S. government. Expanding the customer base would reduce concentration risk.Better margins

U.S. military contracts often come with strict bidding processes and margin limitations. Foreign customers, especially in smaller or politically unstable countries, are often willing to pay higher prices if quality, reliability, and delivery timelines are solid.Utilization of capacity

McRae already has an established and proven military boot production setup. If U.S. orders soften, like they did in 2025, foreign sales could help keep the factories running near full capacity.

I see a lot of potential in this expansion strategy.

And I also like how openly McRae communicates with shareholders about it. For instance, they wrote:

“We continue to pursue new business opportunities with the U.S. military and other foreign militaries.”

And

„We also have a contract with a foreign government for military combat boots and are working hard to increase our commercial military boot sales.“

This may be just one example, but McRae has a history of openly discussing their plans, possibilities, challenges, and shifts in market trends. They speak to shareholders like partners.

That boosts my confidence in the quality of their management team, especially in an era where too many executives treat annual reports like marketing brochures and try to hide problems until they’ve grown too big to ignore.

Valuation

McRae currently trades at a P/E of 8.7, far below its 20-year average of around 20x earnings. It offers a 3% dividend yield (including the recent special dividend) and trades just around book value, with a P/B ratio of 1.04.

Given the company’s consistency, strong balance sheet, and growth potential in its military segment, I think it’s clearly undervalued.

It’s a rare little opportunity for anyone looking to own an old-school business that doesn’t seem like it’s going away anytime soon.

Tariffs

Even though there’s very little coverage on McRae out there, I still came across concerns about the potential impact of tariffs.

And while that’s always a fair thing to watch, the company addressed this directly in its latest quarterly report:

„At this time, our income has not been materially affected by tariffs. We are sourcing boots primarily from Mexico and India, with a small amount of production coming from Vietnam. Future tariffs are uncertain, as well as the impact they will have on our income and supply chain.“

So, yes, things could change. And with their expansion plans, they may run into some tariff issues down the line. But for now, they seem to be unaffected.

Competitors

McRae’s biggest competitor is the company behind Justin and Tony Lama boots, which happens to be Berkshire Hathaway. But since boots make up only a tiny piece of the broader conglomerate, there’s virtually no disclosure.

A more relevant comparison is Rocky Brands (NASDAQ: RCKY), a public company that, like McRae, focuses only on boots. There’s a slight difference in product mix. Rocky gets most of its sales from work boots (about $190 million), while Western footwear is secondary ($82 million). Rocky also has a significant military business ($39M of sales).

Rocky Brands is actually an interesting potential investment in its own right. I thought about writing about them before. However, I like McRae much more.

Their balance sheet is in much better shape. McRae carries no long-term debt, while Rocky has quite the debt load. Also, Rocky’s sales have declined recently, while McRae’s have merely flattened. And while Rocky trades at (a still-cheap) 12.5x earnings, McRae trades at just 8.7x.

Dimeco, Inc.

The case for the second stock is just as interesting.

The business is called Dimeco, Inc. ($DIMC), or, as their website puts it, simply “The Dime Bank.”

Pretty funny name, if you ask me.

As the name suggests, this is a small regional bank, with a market cap of just $92.6M. And a pretty old one at that. Founded in 1905, the bank has been around for 120 years, serving its local community in northeastern Pennsylvania. Today, it operates out of seven branches in the region.

Dimeco does what you’d expect from a classic community bank: it focuses heavily on real estate lending, both residential and commercial, and also makes consumer and small business loans.

What I really like about this bank is how well-managed and consistent it is. Over the past 30 years, shareholders have seen more than 10% annual returns, including dividends.

Still, despite this long-term strength, the market seems to have missed the growth of the past eight years, with shares trading at roughly the same price as in 2017.

That creates a pretty clear discount opportunity today.

The Numbers

Honestly, there’s nothing spectacular about Dimeco’s numbers. They don’t have explosive growth, nor do they have unseen profitability. But what they do have is consistency and experience.

They’ve been profitable every year for at least the past two decades, and they’ve paid a dividend every single year since at least 2000.

The opportunity with DIMC doesn’t lie in recent performance, but in its valuation. As I just mentioned, shareholders somehow still value the company the same way they did in 2017, completely ignoring the growth achieved since then. I'll discuss this in more detail in a moment.

But first, let’s quickly look at what’s been happening on the income statement and balance sheet.

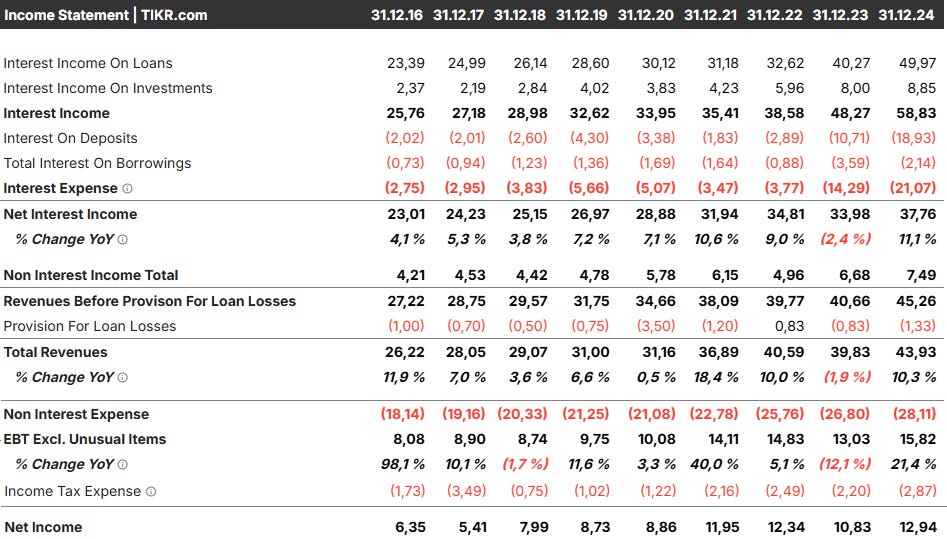

Income statement

Over the past decade:

Interest income grew at a 10.87% CAGR

Net interest income compounded at 6.38%

Total revenue at 6.6%

Net income at 9.3%

2024 performance was above average in every respect:

Interest income rose 22% to $58.83 million

Net interest income grew 11.1%

Total revenue increased 10.3%

Net income jumped from $10.83M to $12.94M, a +19.5% increase

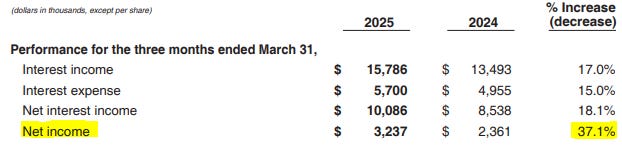

And the momentum continued into the latest quarter:

Net income grew an impressive +37% year-over-year, with all major metrics showing strong YoY growth.

The stock currently yields 4.5%, and the dividend has grown at an average rate of 6.1% annually over the past decade.

With a payout ratio of just 31.3%, well below the 10-year average of 40%, I see no reason why that growth should slow down anytime soon.

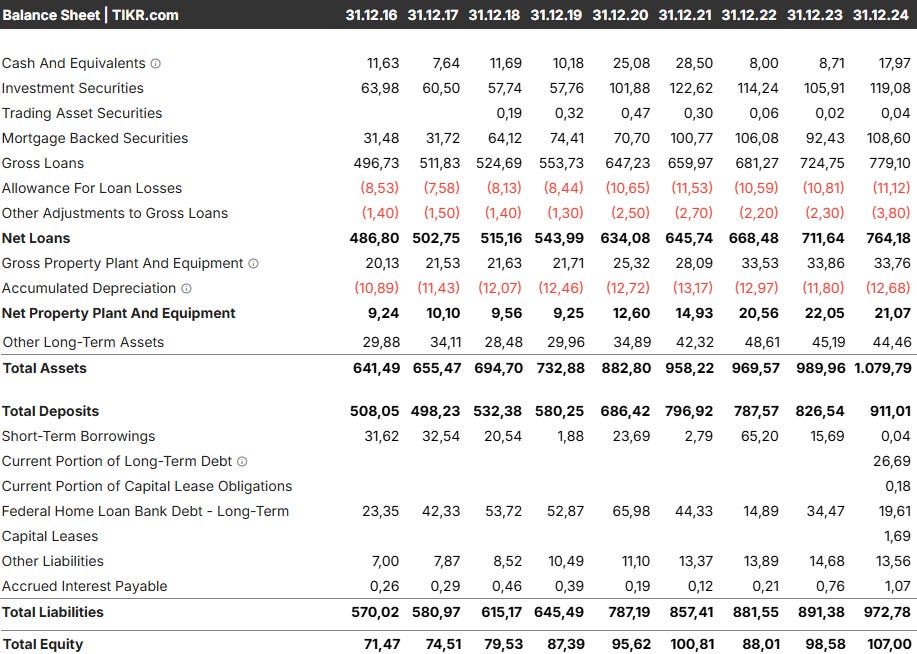

Balance Sheet

The balance sheet tells a similar story.

Over the past decade, net loans grew at a CAGR of 5.8%, while total deposits grew even faster at 7.4%. 2024 came in slightly above that average, continuing the long-term trend.

Aside from mortgage-backed securities, the bank holds an investment portfolio worth ~$120 million. Combined with the $24.2 million in cash they reported in their most recent quarterly filing, that’s more than 1.5x their current market cap.

In 2024, total assets crossed the $1 billion mark for the first time.

As of March 31, 2025, total assets stood at $1,106,576,000.

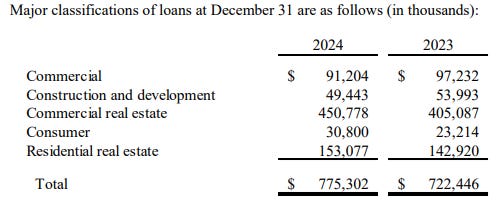

Looking at the loan portfolio, it’s clear: Real estate lending is their bread and butter.

This matches well with the mortgage-related securities in their investment portfolio and suggests a focused expertise in real estate lending.

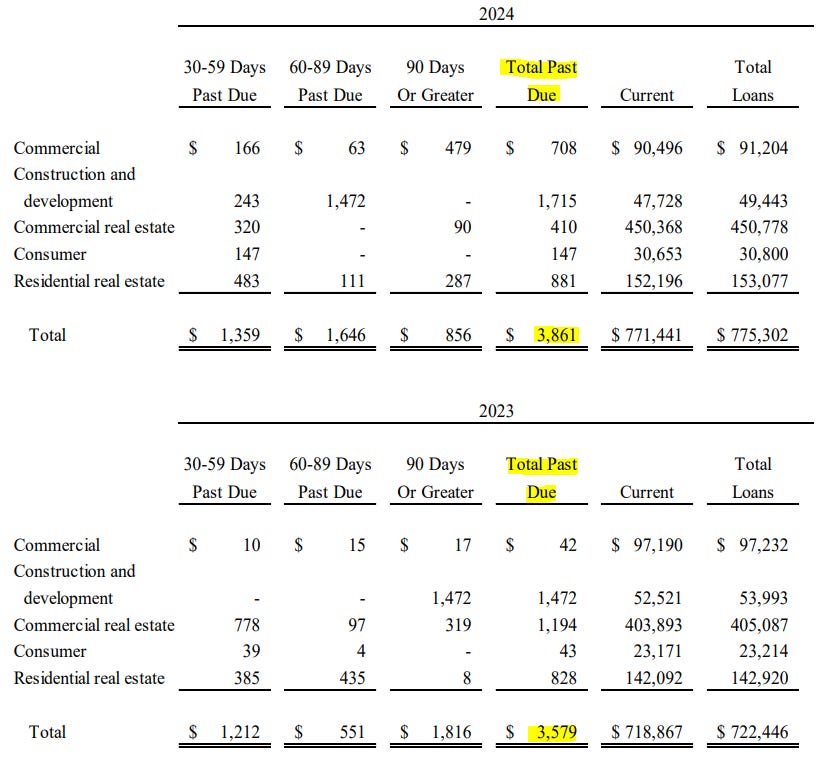

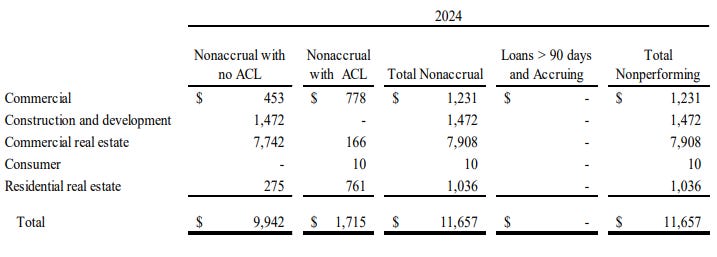

The value of overdue loans increased slightly, from $3.58 million in 2023 to $3.86 million in 2024, a modest increase of about 8%.

As of Q1 2025, the nonperforming assets to total assets ratio stands at 1.12%. That’s up slightly year-over-year, and it’s worth keeping an eye on, but still sits well within a healthy range.

Their allowance for credit losses (ACL) ended 2024 at $11.1 million, which reflects an increase from the prior year.

“In 2024, the ACL for loans increased by $317 thousand due to an overall increase in the loan portfolio and a slight increase in the historical loss rate.“

Most importantly, the ACL-to-nonperforming loans ratio is still above 100% (100.92%), which is another clear sign of competent management.

Again, there’s nothing jaw-dropping here. The bank I wrote about here, for example, had a 22.5% CAGR.

Still, it’s a a strong, well-managed bank with a healthy balance sheet and a consistent growth track record.

Thanks to the current market mispricing, the stock is available at a deep discount.

Let’s take a closer look at that next.

Valuation

Looking at the chart, you’ll notice that shares trade at roughly the same price today, around $36, as they did back in 2017. Assuming nothing has changed since then.

However, this is absolutely not the case.

Since 2017:

Interest income more than doubled

Net interest income grew by over 55%

Total revenues are up more than 56%

Net income grew from $5.41 million to $12.94 million → that’s a 140% increase

Net loans grew by 52%

Total deposits rose by 83%

So it’s clear: this bank has steadily improved across the board, year after year. And the business is clearly in a much stronger position than it was eight years ago.

And yet the valuation completely ignores that progress.

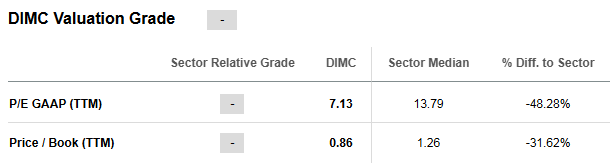

The stock trades at a P/E of just 7.13, nearly 50% below the average for its sector.

And at a price-to-book of just 0.86, also well below most regional banks.

At ~$36, this disconnect represents a nice opportunity to buy a well-run, profitable, steadily growing regional bank at a discount.

Of course, cheap alone isn’t enough, asset quality needs to be taken into consideration as well.

So let’s take a quick look at that next.

Asset Quality

As of the first quarter of this year, Dimeco reported a Return on Assets (ROA) of 1.18% and a Return on Equity (ROE) of 11.88%.

Both numbers are solid. ROA is nicely above the 1% threshold I generally look for, and ROE sits comfortably above the 10% mark.

In their 2024 annual report, they proudly stated:

„The efficiency ratio ended the year at 61.37%, which was a decrease of 5.6% over 2023, showing noticeable improvement.“

And it got even better in their most recent quarterly report.

The efficiency ratio improved further to 58.47%, a 12.9% year-over-year improvement from Q1 2024’s 67.10%.

Non-performing assets make up 1.16% of total assets. That’s well within an acceptable range for a bank of this size.

Overall, I’d say their asset quality looks very solid.

Risks

There are a few risks to consider before investing in The Dime Bank.

The first, as with any regional bank, is geographic concentration. Dimeco operates primarily in northeastern Pennsylvania. Should those areas of the country fall into economic trouble or face added regulatory complications, DIMC would be impacted more than most other regional banks.

The second is more general: the macroeconomic environment. Like most smaller banks, Dimeco would be exposed to a broad economic slowdown, especially one involving elevated interest rates, persistent inflation, or a weakening consumer. That could mean shrinking deposits, rising loan losses, and a slowdown in new lending.

Final thoughts

There you have it.

Two old-school, Buffett & Graham-style value stocks. Profitable, time-tested businesses with long histories and solid fundamentals.

They probably won’t be the next 1000-bagger you may have been looking for, but they are opportunities to own two quality businesses for less than they’re worth.

I hope you enjoyed it. Until next time.

Noel from Deep Value Insights

Disclaimer: This content is for informational and educational purposes only and should not be considered investment advice. I’m just sharing my thoughts -- not telling you what to do with your money. Some of what I write may turn out to be wrong. Always do your own research.

Looks like McRae has a new intern in the finance department with design skills.😀