Key metrics:

2.3x earnings

40% below net cash

84% discount to NCAV

It always amazes me how far down the market rabbit hole goes.

When I first started investing, I thought blue-chip stocks were the way to go.

Then I made some money in Skechers and thought, okay… maybe it’s not just Coca-Cola.

Then I discovered microcaps and realized the absurd valuations you can find there.

Back then, I figured “microcap” meant anything down to maybe a $10 million market cap. I mean, how are you even supposed to build a position in something smaller? Heck, it’s already challenging enough in a $10M stock.

But then I got introduced to the super small microcaps.

It started with a tweet from a guy who had just doubled his money in a stock with a $960K market cap, trading below net cash and at just 2.6x earnings.

That kind of valuation… sure, for a dying business on the edge of bankruptcy, maybe that’s fair. But for a profitable one? What the heck.

From there, I started reading one blog after another. Most of them looked like they’d been built right after the internet was invented. But the more I read, the more I realized there was an entire community around these kinds of stocks.

And for good reason.

The opportunities in these tiny corners of the market are on another level when it comes to inefficiency.

I knew Buffett used to invest in stocks like this when he was managing small sums. I just thought those days were long gone.

Boy, was I wrong.

Today’s stock is a perfect example that these opportunities are still out there.

It’s a tiny stock I found while digging through the OTC market.

With a market cap of just $406,485, it trades below net cash, at a huge discount to NCAV, and at a ridiculous earnings multiple of only 2.3x.

Conair Corp.

Conair Corp. $CNGA now files its reports on the OTC Pink Sheets. In the past, though, the company filed with the SEC, and for quite a while. They went public in 1969 and de-registered in 1995.

After that, they completely disappeared. They did not file reports anywhere. The stock price plummeted, and shareholders must have wondered if the company was even still alive.

CNGA stayed in the dark for 22 years until, in September 2017, they suddenly filed quarterlies and an annual report. Since then, they’ve kept up with filings and even put out press releases! For a company that had been silent for decades, that’s a pretty big shift.

Let’s look at the chart. The stock hit a low of $0.005 in 2011, if you were lucky enough to buy there, you’d have made 151x your money within five years.

I don’t know what changed in 2012, but the stock climbed back up and traded around $0.40 for a couple of years. It was about $0.50 when they started filing again in 2017.

After that, shares traded in the $0.50–$0.90 range for a while.

So here we are: an illiquid company with a tiny share count that was dark for 22 years, came back to life with consistent reporting, has stable revenue and profitability, and yet today trades almost back at its darkness lows.

How can that be?

Spoiler: they filed a bad quarterly report.

The Business

In short: Conair has been in the HVAC business in New York since 1963.

They focus mainly on designing, installing, and servicing large commercial air conditioning and refrigeration systems, but they also do residential work.

Because of their long history, they like to present themselves as a trusted regional provider.

On their website theconairgroup.com, they even highlight the fact that they are publicly traded on the Pink Sheets.

In recent years, they’ve also tried their hand at franchising, offering others the chance to operate under the Conair name. That move may even be what pushed them to start filing again.

So far, though, the franchise segment hasn’t really taken off. More on that later.

The Numbers

The company has no long-term debt. The share structure is clean, with just common stock, and the float is tiny.

Since coming back to the light, they’ve put out regular press releases on OTC Markets, which I like a lot.

Some of them are only a single sentence, which is a bit odd, but hey, at least they’re communicating.

Ownership is very concentrated. CEO Barry Stransky owns 49% of the common, while Mark Stransky owns another 34%. That leaves only about 20% as free float, or 1,211,862 shares.

It’s unclear when exactly the Stranskys got their shares, since they weren’t listed in the last proxy back in 1995.

Barry’s LinkedIn says he’s been with the company since 1993, and judging by his profile picture (which may or may not be up to date), he looks to be in his late 50s.

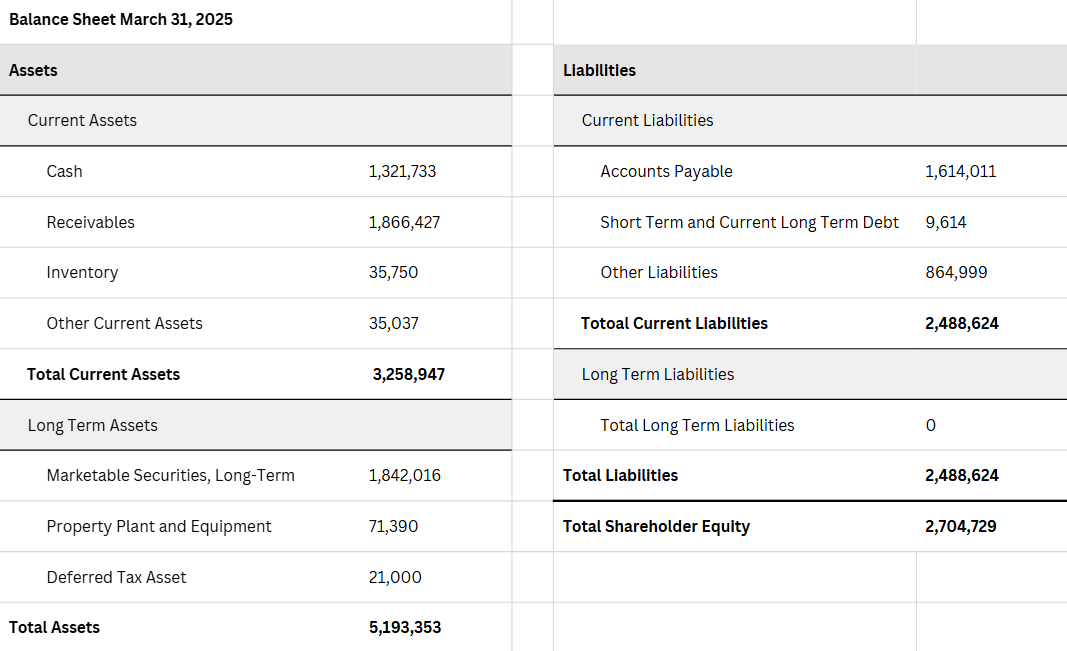

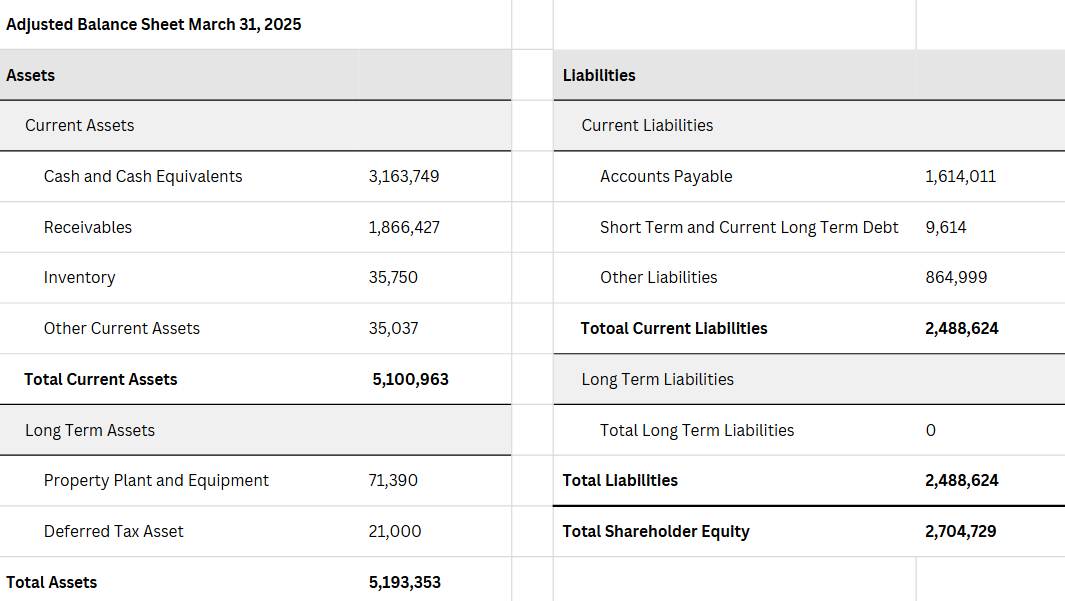

Now to the balance sheet:

Based on current assets, their NCAV comes out to about $770,323.

With a current market cap of $406,485, that’s already a 47% discount to NCAV.

Cheap on its own.

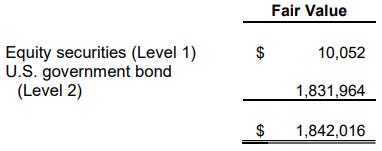

But the real kicker is their $1.8M in long-term assets under “Marketable Securities.”

The annual report shows that most of this is in U.S. government bonds with a small slice in equities.

Normally, you’d expect those kinds of securities to sit under current assets. But since the plan is to hold them for more than 12 months, they’re booked as long-term.

Either way, it doesn’t change much. They could still be liquidated quickly and near dollar value.

So it’s fair to mentally treat them as cash.

That brings total cash and equivalents to $3,163,749.

Subtracting all liabilities leaves an absolute net cash balance of $675,125.

Which means the stock trades not only at a big discount to NCAV, but also about 40% below net cash.

And if you adjust NCAV to include those securities, it comes out to $2,612,339, putting the true discount at a massive 84%.

But why is it so cheap?

The answer is simple: the company recently reported a bad quarter. A shareholder didn’t like that, dumped his shares, and the price tanked along the way.

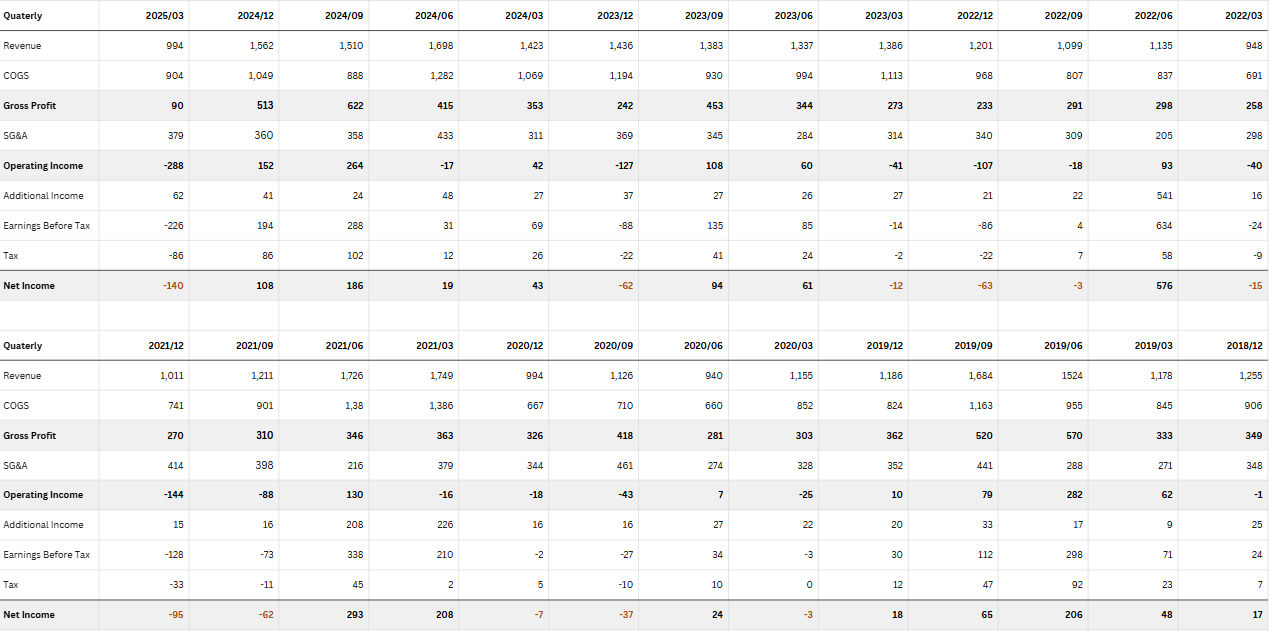

I went through all of their quarterly reports and have summarized the last 26 here:

And as you can see, it’s not unusual for CNGA to post one, two, or even three negative quarters in a row. I marked all of them in red.

Their most recent one, though, is the worst they’ve reported since they started filing again.

Even so, I don’t think it changes the thesis.

The weak quarters are pretty easy to explain.

It comes down to customer concentration.

In their most recent filing, management stated:

So a bad quarter is most likely just the result of losing a customer or seeing reduced demand from one of them.

And again, this isn’t new. Since they started filing again, 11 quarters have shown a net loss, and I’d bet the pattern goes back even further.

But on a yearly basis, the company usually reports a profit.

Over the last twelve months, they earned about $173,000, and that’s including the most recent quarterly loss of roughly $140,000!

Still, after that sell-off, shares crashed to $0.067, giving the company a market cap of just $406,485. Keep in mind, before that, shares were trading in the $0.40–$0.80 range, with a market cap of around $2–5M.

So today, the stock trades at just 2.3x earnings.

Given the company’s long history of bouncing back from these dips, I think it’s likely they’ll return to profitability soon. If that happens, the stock price could, and should, move up again.

Of course, there’s risk. It could take longer than one would like before the company returns to profitability again. But with the stock now trading at an 84% discount to adjusted NCAV, the margin of safety looks more than sufficient, and the downside feels well covered.

Why they started filing again

The company’s move back into regular filings seems tied to their attempt at building a franchise business. To attract franchisees, they needed a decent stock price and audited numbers they could show off.

So they started filing again.

In December 2017, they even launched a separate website for this effort: conairhvacfranchise.com. The plan was to expand into states like New Jersey, Connecticut, Pennsylvania, Massachusetts, and Florida.

On the site, they even mention a “strategic potential exit” as a selling point for franchisees.

To me, that reads like the idea was to let others build up successful locations under the Conair name, and then Conair could later acquire them with relatively little risk.

But it hasn’t worked out. The franchise segment never really took off. Their last annual report makes that clear:

„There were no franchise-related revenues earned during the years ended September 30, 2024 and 2023.“

So while franchising might have been the trigger for renewed filings, it hasn’t been a meaningful part of the business.

Why it’s cheap

When I look at tiny microcaps, I always ask myself: why is it cheap? If I can’t find a good reason, it’s usually a pass.

In this case, the reason is obvious. With a current market cap of just $400K and trading on the OTC Pink Sheets, the stock is simply too small.

No one is watching it. No one noticed when the price dropped below net cash. In fact, the price has been sitting at this level since June 10th, and there hadn’t been a single trade for 54 days.

Final thoughts

What we’re looking at here is a tiny company with less than half a million in market cap, that got sold off after a bad quarter and now trades at dirt-cheap multiples.

40% below net cash, 84% below NCAV, and just 2.3x trailing earnings.

Sure, it’s not without risk. They could post a few more bad quarters, lose a key customer, or even decide to stop filing altogether and go dark again.

But at these levels, the margin of safety feels substantial. The balance sheet is clean, there’s virtually no bankruptcy risk, and with shares trading below liquidation value, the downside looks very well covered.

To me, this is a reminder that true market inefficiencies still exist, just not where most people are looking. Buffett used to say he built his fortune buying tiny, overlooked businesses when he was managing small sums. This is exactly that kind of setup.

The thing is, they’re just really hard to find. You won’t see write-ups on them on VIC or Seeking Alpha. You have to dig them out yourself, by flipping through hundreds of tickers, one after another.

And every now and then, you stumble on something like this. A company that looks forgotten, unloved, maybe even a little weird, but is sitting there with a pile of cash, positive earnings, and trading for pennies on the dollar.

That’s the joy of hunting in the corners of the market.

Disclaimer: This content is for informational and educational purposes only and should not be considered investment advice. I’m just sharing my thoughts—not telling you what to do with your money. Some of what I write may turn out to be wrong. Always do your own research.

Have you considered the implications if the company were to sell those bonds? As long as they’re classified as held to maturity, the firm doesn’t have to mark them down to current fair value. I don’t know when they bought them, but for example, if the bonds were purchased back in 2020 near 0% rates and are now trading at ~70 cents on the dollar, the unrealized loss doesn’t show up. But if the company decided to liquidate, they’d be forced to recognize that loss.

You lacked to discover further due diligence on the operators - the HVAC company named Conair. The principals defaulted on a performance bond with a Catholic school on Long Island and the school hired a replacement contractor to finish the work. The work was inspected for the school by a well regarded engineering firm that found the faulty work. The HVAC company did not complete the corrective work and the performance bonding company, Travelers Surety, stepped in to hire the replacement contractor to finish the job. The corrective work cost Travelers close to 2.5 million dollars. Horrible track record. Horrible analysis, horrible stock pick.