Cash, Buybacks, and a Simple Business That Works

7.7x earnings. Buying back shares.

Key metrics:

7.7x earnings

5.2x EV/EBITDA

Special dividends and buybacks

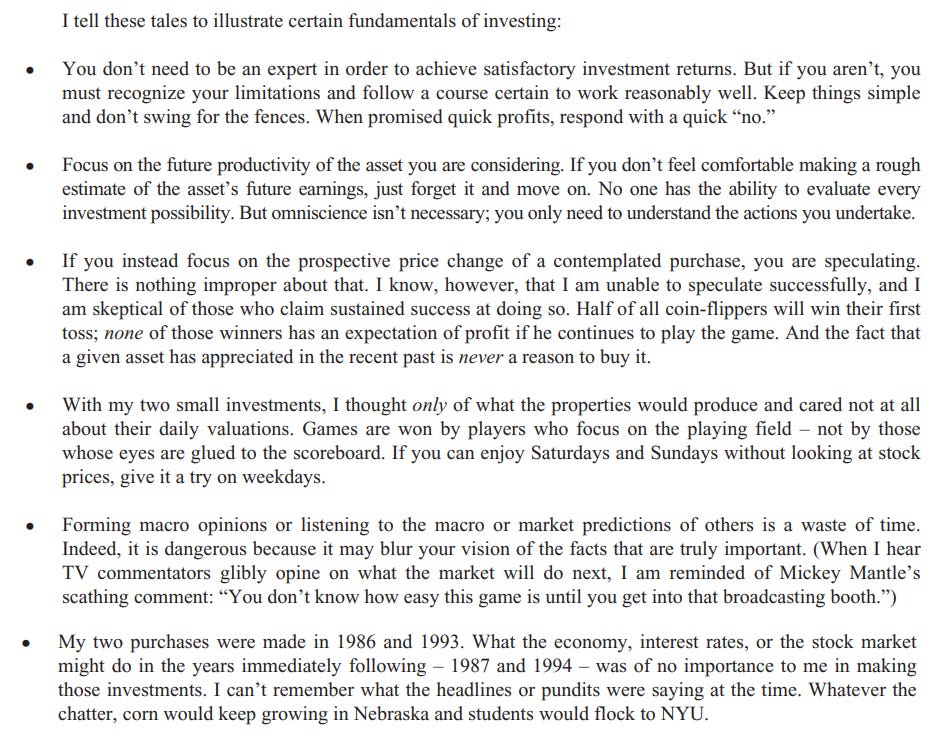

“Investing is simple, but not easy.” ~ Warren Buffett

There’s a lot of wisdom hidden in Buffett’s shareholder letters.

I reread them often, and every time I find something new.

In his 2013 letter, one part really stood out to me.

He talked about two simple real estate investments he made with his own (non-Berkshire) money. One was a small farm he bought in 1986. The other, a New York rental property in 1993. Both turned out to be great successes.

Now the interesting part isn’t in the details of the deals, it’s in how simple his thinking was.

He didn’t use complex spreadsheets, no macro forecasts, no earnings models, just basic principles, common sense, and conservative analysis.

He followed it up with an incredible set of principles that sum up how he thinks about investing:

I think that does a great job of showing what good investing really comes down to: not overcomplicating things that don’t need to be complicated.

Today’s stock fits that idea. It’s a simple, straightforward case.

A company that’s gone through major changes, come out stronger, and now trades for less than it’s worth.

Simple as that.

Let’s get into it.

Q.E.P. Co., Inc.

Ticker: $QEPC Market Cap: ~$122M

Q.E.P. Co., Inc. is a Boca Raton, Florida–based manufacturer and distributor of flooring installation tools. The company serves both professional installers and home-improvement markets with a wide range of practical, hands-on products.

In recent years, QEP has gone through major changes, reshaping its business and financials from the ground up.

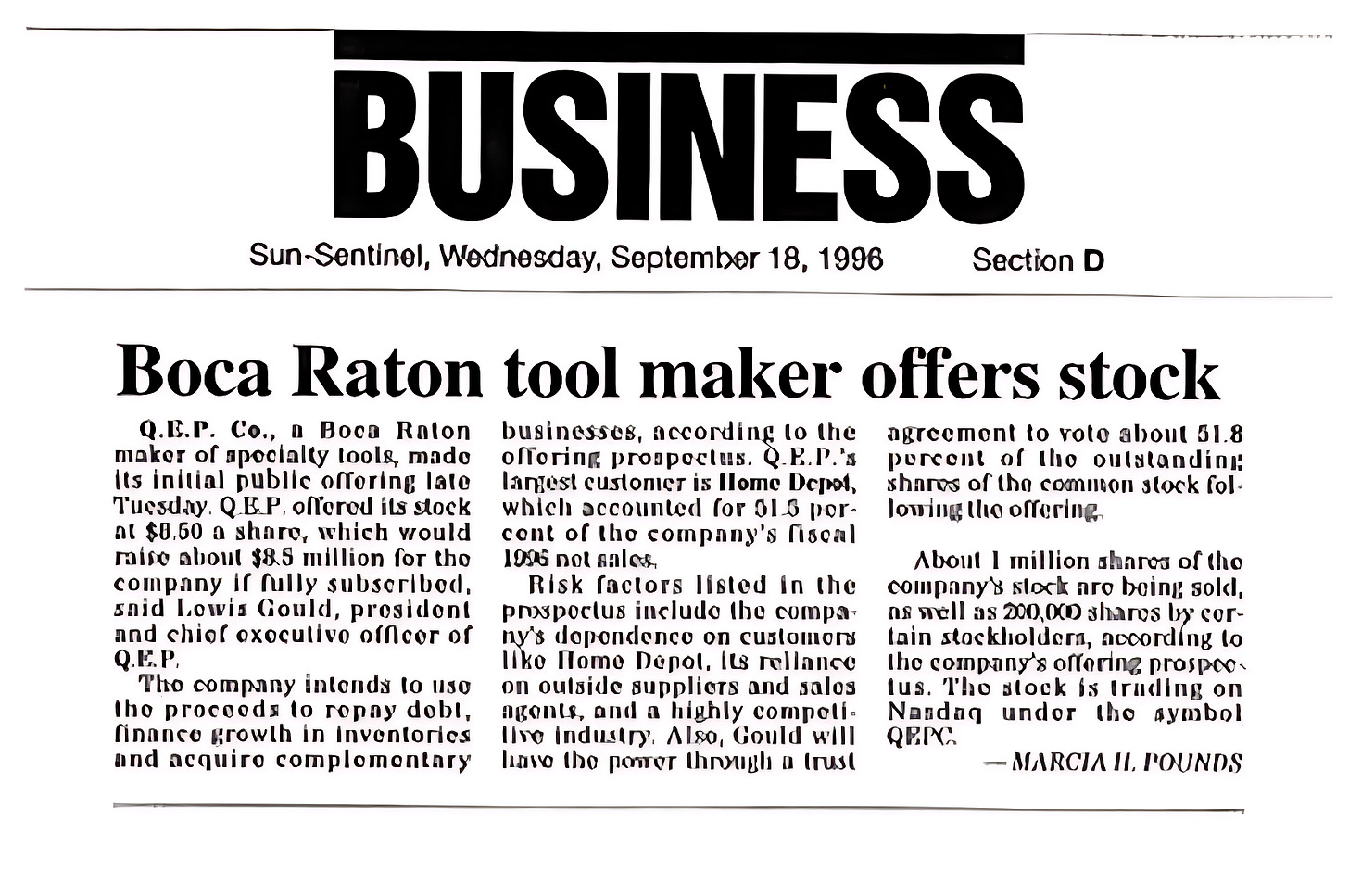

The story began in 1979, when businessman Lewis Gould opened a small family business.

He decided to sell electronics and named the company Quality Electronic Products, or Q.E.P. But instead of focusing on high-tech, he created a simple bathroom-edge kit, made and packaged right in the family garage.

It really was a family business. While Lewis was out meeting customers, his wife and 10-year-old son, Leonard, stayed home packing orders.

It was a truly humble beginning.

Before long, distributors began asking for tile tools used by floor installers (cutters, saws, trowels, spacers, and more). Gould had no idea what these tools were, but he was driven and ambitious, so he started to educate himself, learning the ins and outs of tile installation.

With that knowledge, he adjusted to market demand, and the company shifted from electronics to flooring tools.

The most significant step came in 1982, when the then-newly founded Home Depot chose Q.E.P. as its main flooring products supplier. That partnership allowed Q.E.P. to grow alongside Home Depot’s rapid expansion.

Over the years, the business grew and kept improving. During the 1980s, Q.E.P. began its run of acquisitions to fill out product lines and fuel further growth.

In need of capital to fund further growth, they went public in 1996, raising $10.2 million.

After further strengthening the tool side of the business through more acquisitions during the 1990s, Q.E.P. decided to expand overseas. For a time, this strategy of deals and new markets gave the company strong momentum in its quest to become a global leader in flooring installation products.

By 2000, Q.E.P. generated $113.6 million in annual revenue and $3.2 million in net income, with shares trading around $6.

The company continued buying up smaller brands through the 2000s, expanding into Europe, Australia, and South America.

But in the late 2010s, Q.E.P. wanted to try something bigger. They wanted to sell actual flooring, not just tools.

To do that, the company built the Harris Flooring Group and other flooring brands. This move brought scale, but it also lowered margins and brought more risk. The results were uneven, and profits came under pressure. 2019 marked the first year in company history with an operating loss.

The business had focused so much on expansion that it almost forgot its core segment. The lesson was clear. Tools and installation products were Q.E.P.’s true core.

By 2023, founder Lewis Gould, now 79, began stepping back. His son Leonard, who had been literally involved in the business since he was 10 years old, took over as CEO and changed course.

Starting in 2023, Q.E.P. began a full reset to focus only on North America and on its strongest products: tools, adhesives, and underlayments.

In September 2023, Q.E.P. sold key Harris Flooring Group assets. The following month, in October 2023, it sold its U.K. business through a management buyout. In March 2024, the company completed the sale of its Australia and New Zealand operations, and in March 2025, it sold PRCI in France, completing its exit from international operations.

After these moves, Q.E.P. is simpler and stronger again. The company’s focus has returned to what made it successful in the first place, being a domestic leader in flooring installation products.

Through these sales, both profitability and the balance sheet have improved significantly. The company is now clearly overcapitalized and is returning excess cash to shareholders through dividends and buybacks.

Not only that, but the stock is trading at very low multiples and is valued well below what it should be.

Let’s take a closer look at the numbers.

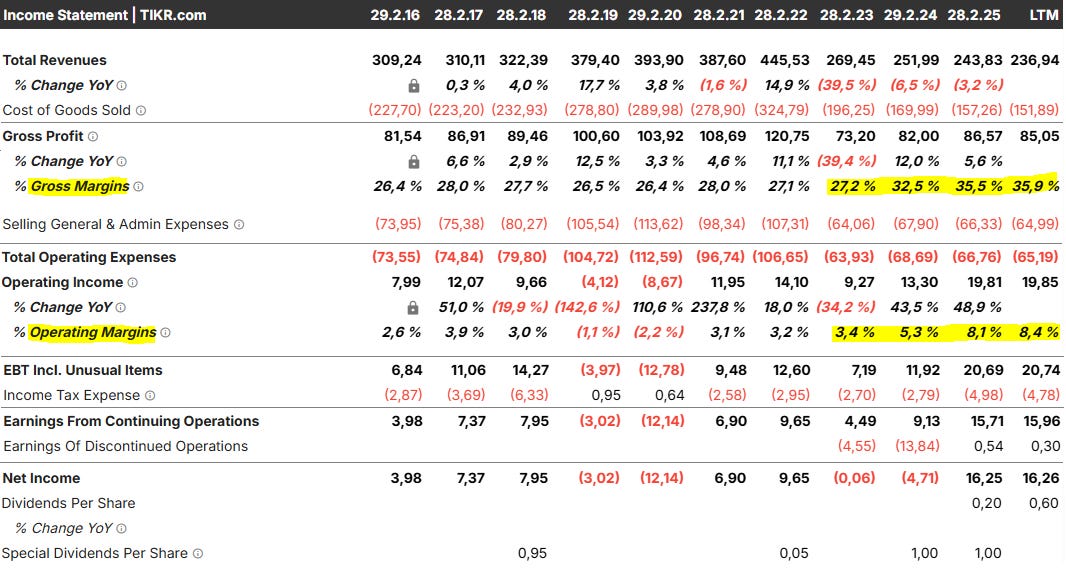

Income Statement

→ Income statement excerpts

The changes Q.E.P. has made over the past few years are clearly visible in its income statement.

Revenue has come down from the 2020–2022 highs, but profitability has improved dramatically. Gross margins have expanded since 2023, reflecting the company’s sharper focus on its core tool and accessories business.

The segments that once dragged down earnings are now gone. The floor-covering division, which was capital-intensive and low-margin, has been sold. What remains is the installation tools and adhesives segment, a business that has always been profitable but was overshadowed by the weaker flooring operations.

Selling, general and administrative expenses are also down significantly. As a result, operating margins have more than doubled, moving from around 3% to over 8%.

That puts operating income at an all-time high, even with a smaller revenue base.

The improvement flows straight through to the bottom line. Net income is the strongest it has ever been, showing just how much the company’s turnaround has strengthened its overall profitability.

Dividends

One clear way Q.E.P. is returning its growing cash pile to shareholders is through dividends, both regular and special.

After years without a steady payout, the company introduced a quarterly dividend of $0.20 per share in 2025.

Before that, management used special dividends to distribute the excess cash generated from the sale of non-core businesses.

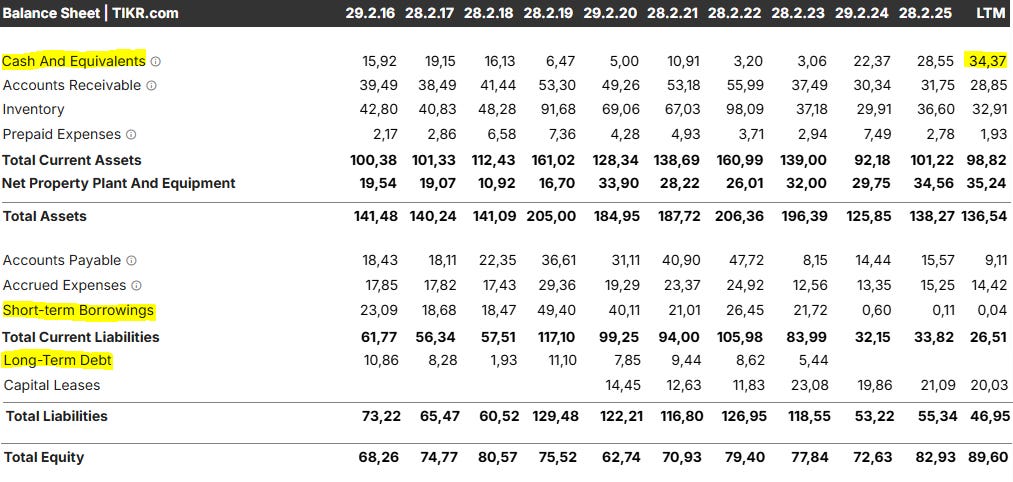

Balance Sheet

→ Balance sheet excerpts

Their balance sheet looks strong, but it hasn’t always been that way. The changes Q.E.P. made in the past few years completely reshaped its financial position.

First, debt was paid down. What had once been a leveraged balance sheet is now nearly debt-free, aside from small capital leases.

As the most recent quarterly report put it:

„Our balance sheet has never been stronger.“

With debt gone, cash has built up. And the company now holds more cash than ever before, roughly 28% of its entire market cap. That gives Q.E.P. remarkable resilience and virtually no bankruptcy risk in the foreseeable future.

And the company is putting that cash to good use.

Alongside its new quarterly dividend, Q.E.P. continues to buy back shares under its repurchase program. While the amounts were modest in earlier years, buybacks have become more meaningful as profits and cash flow have improved.

I also like that there’s never been any dilution, just buybacks. That’s a good sign of quality management.

Valuation

Investor returns ultimately come from three main sources, or ideally, a combination of all three:

(1) The first source of investor returns comes from a higher valuation multiple on a company’s assets or earnings. If, for example, the market assigns a higher P/E or P/B ratio to a stock, investors benefit. That’s why deep value investors often buy stocks trading at low price-to-book ratios, expecting that at some point, the market will revalue those assets upward. As Ben Graham and Walter Schloss proved over decades, this revaluation effect often happens.

(2) The second driver of returns comes from the internal results of the business itself. Even if the market keeps valuing a company at a constant multiple (say, a P/E of 15), investors still benefit as long as earnings per share keep rising. That growth might come from organic improvements, better margins, or disciplined acquisitions. In that case, the stock price increases even without any change in market perception.

(3) The third source comes from management’s capital allocation decisions. A company can create real shareholder value even with flat growth and no change in valuation, simply by returning capital through dividends and buybacks.

The best case, of course, is a mix of all three, valuation improvement, stronger business performance, and smart capital allocation. Together, they create a compounding effect that builds long-term shareholder value.

You could sum it up in one simple equation:

Valuation + Growth + Capital Allocation = Value.

As Warren Buffett once said, “Value and growth are joined at the hip.”

Now, Q.E.P. might not show much top-line growth right now, but what it does have is clear improvement. Combine that with a low valuation and thoughtful capital allocation, and the ingredients for value creation are all here.

Q.E.P. currently trades at roughly 7.7x earnings and 5.2x EV/EBITDA.

For context, the industry average EV/EBITDA multiple is around 11.3x, while the industry leader, Stanley Black & Decker ($SWK), trades closer to 11.9x. Smaller deals in the hand and power tools industry are often done at 12–13x EV/EBITDA, showing that QEP trades at a deep discount to peers and private-market values.

That said, some discount is justified.

Home Depot remains Q.E.P.’s largest client, and insider ownership is high, so a small valuation haircut makes sense.

At 1.36x book value, this isn’t a classic deep-discount-to-book situation. Here, the story is more about the turnaround, the internal improvements that lifted profitability, strengthened the balance sheet, and allowed management to start returning capital through dividends and buybacks.

These shareholder-friendly actions, combined with a large cash position and consistent earnings, leave room for further upside, and possibly more special dividends or buybacks ahead.

According to Joel Greenblatt, “Value investing is simply figuring out what something is worth and paying a lot less for it.”

I may not have an exact number for what Q.E.P. is worth today, but after all the divestitures and improvements since 2023, it’s clear that the stock looks remarkably undervalued and is trading for far less than it’s worth.

Risks

The first and most obvious risk comes from customer concentration.

Home Depot has been Q.E.P.’s largest customer since the very beginning, and that relationship remains critical today. In FY2025, sales to Home Depot made up about 66% of total revenue.

This kind of concentration naturally brings risk. If Home Depot were to reduce orders, change suppliers, or shift product strategies, the impact on Q.E.P. would be significant.

That said, it’s worth highlighting that this partnership goes back over 40 years. Q.E.P. has been supplying Home Depot since its founding days. The two companies have effectively grown side by side. Q.E.P. wouldn’t be where it is today without riding Home Depot’s multi-decade expansion, and that long history gives the relationship a level of stability few suppliers enjoy.

Still, dependence on one major customer can never be ignored. It remains the company’s most important risk factor. If the relationship were ever to change, for whatever reason, it would be a major setback.

The second consideration is ownership concentration.

The Gould family holds roughly 49% of the company, giving them effective control over all major decisions.

This structure keeps management’s interests tightly aligned with shareholders, but it also means minority investors have limited influence. Any leadership changes or family succession could have an outsized impact on the company’s direction.

The third point to watch is capital deployment.

After completing its turnaround, Q.E.P. now holds significant cash and no debt. The risk here is that management could once again start spending too aggressively, especially through acquisitions.

However, given their renewed focus on the core tools and accessories segment, any future acquisitions are expected to be much more disciplined and tied to their existing business.

Unlike in the late 2010s, when expansion stretched the company too thin, today’s management appears more measured and focused on building sustainable, high-return operations.

Final thoughts

Value investing is about finding something that’s trading for less than it’s truly worth.

And that’s clearly the case here.

Since the management change in 2023, Q.E.P. has improved almost every part of its operation. Margins are higher, the balance sheet is cleaner, and capital allocation has been excellent.

The beauty of Q.E.P. is that the turnaround is already done. And more importantly, there was never anything wrong with the core business to begin with. The real mistake was trying to expand into something it wasn’t, and that’s now behind them.

At this point, it’s a simple investment case.

You have a well-run, profitable company that’s refocused on what it does best, trading at a low multiple, with a strong balance sheet and excess cash being returned to shareholders.

It’s great to find something cheap. But when that “cheap” business is also improving from the inside, it gives you an even wider margin of safety.

Disclaimer: This content is provided for informational and educational purposes only and does not constitute financial, investment, legal, or tax advice. I am not a registered investment advisor or broker. Nothing written here should be relied upon to make investment decisions. Always conduct your own research and consult with a qualified financial advisor before investing. I may or may not hold positions in the securities discussed, and that may change without notice. Any mention of a company, security, or strategy should not be interpreted as a recommendation to buy, sell, or hold. Investing in securities involves substantial risk, including the risk of total loss. Past performance does not guarantee future results. While I make reasonable efforts to ensure the accuracy of information, I cannot guarantee that the content is complete, accurate, or up to date. I accept no liability for any loss or damage arising from reliance on this content.

Light Asst business model ✅

Undervalued ✅

they bought 25 shares in a year, wtf!