An Undervalued Microcap Sitting on a Mountain of Cash

6x earnings. 1.58x EV/EBITDA. A cash pile nearly the size of the market cap.

Key Metrics:

6x earnings

1.58x EV/EBITDA

86% of market cap in cash

Strong insider ownership

The microcap space is a weird place.

This part of the market plays by different rules. It’s not quite the public markets, but not entirely private either. It’s somewhere in between. It’s less liquid, less efficient, and a whole lot weirder.

If you screen enough stocks under, say, a $100 million market cap, you’ll find some odd things. Like broken biotechs trading below cash or sketchy Chinese shell companies. The kind of names you pass on instantly.

But once in a while, you find something else. Something investable.

See, in microcap land, there just aren’t that many eyes watching. Institutional capital mostly stays away. Sure, there are some small hedge funds and value investors poking around. But there’s no Wall Street analyst coverage or Bloomberg terminals lighting up.

That’s how you sometimes find small but solid companies, with growing revenues and strong cash flow, trading at single-digit P/E ratios for no good reason other than nobody’s watching.

Now, let’s be clear: valuation theory doesn’t go out the window just because a stock is tiny. Yes, a liquidity discount is normal. A risk premium makes sense. But a well-run, consistently growing business should still trade somewhere near industry norms.

And yet… sometimes, the market simply doesn’t care.

Especially when a business is boring and the market’s busy chasing the next AI play. That’s how you end up with a small, family-run business with growing earnings quietly compounding, with the stock price barely moving as the market is too slow to catch on. Overtime the valuation then gets cheaper and cheaper.

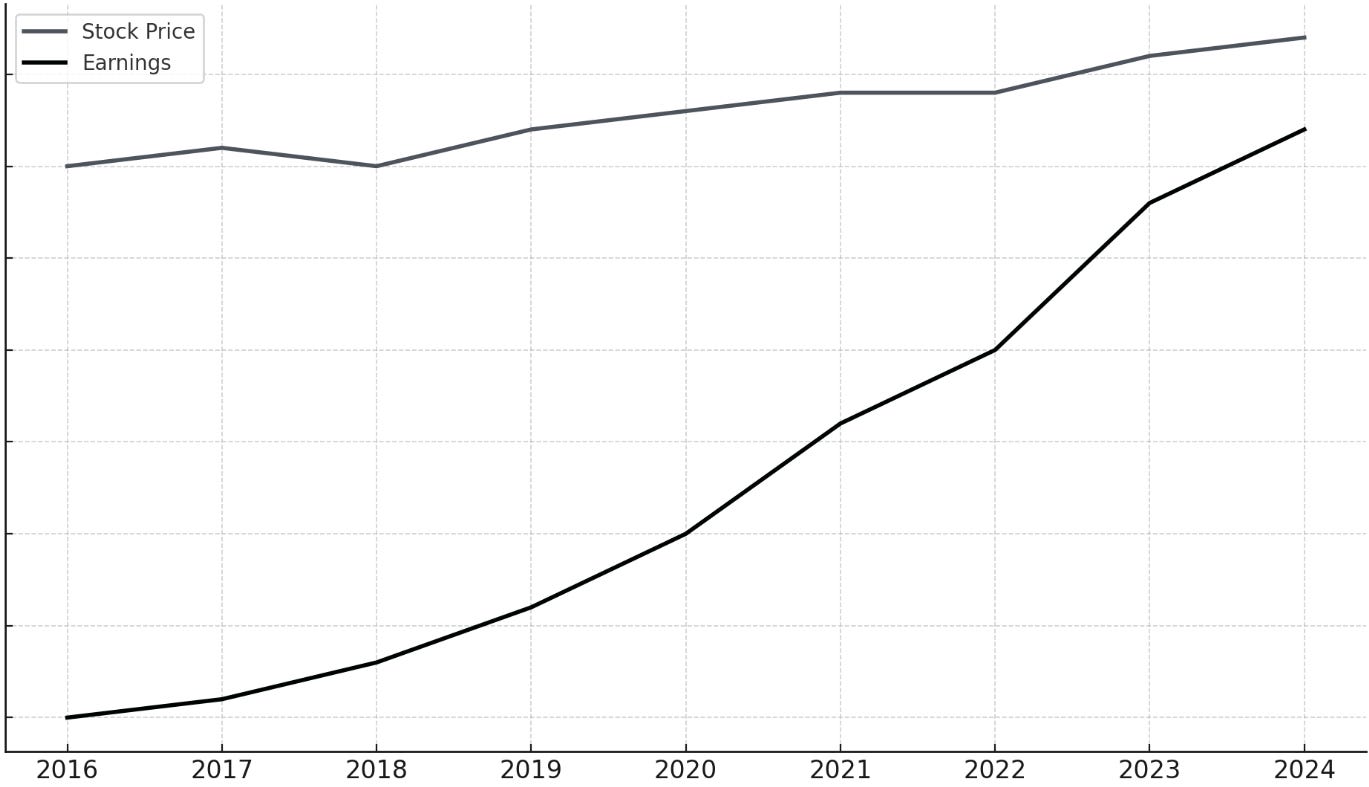

Here is a visual illustration of what happens:

The lower black line represents rising earnings. As you can see, the share price, shown here in gray, stays almost flat. Therefore, the valuation becomes cheaper and cheaper.

That’s exactly what’s happened with today’s stock.

The company has grown revenue steadily for years and used to trade at reasonable multiples. Around 14x earnings and 5.7x EV/EBITDA on average over the past two decades. But today, after years of being overlooked due to its size, it trades at just 6x earnings and 1.58x EV/EBITDA.

Even though that alone, the valuation plus growth, would make a solid investment thesis, there is more to it.

The business is massively cash flow positive. Over time, it’s built up a cash balance almost equal to its market cap. That’s what really caught my attention.

A ton of money. Just sitting there.

Management used some of that cash to pay down most of the long-term debt. But the cash flow is so strong, the cash position still increased.

Since the company is heavily insider owned, there’s a high chance that money eventually flows back to shareholders, whether through a special dividend, aggressive buybacks, or both.

So while the valuation is already attractive on its own the optionality that comes with all that unused cash is what really got me interested.

Let’s take a closer look.

Disclaimer on illiquidity

Before we go on, a quick note.

This stock is extremely illiquid. When I screen for new ideas, I sometimes intentionally include low trading volume as a filter, as it’s one of the best ways to find hidden, overlooked companies.

But that comes with a price. It’s not uncommon for this stock to go several days in a row without a single trade.

That doesn’t make it uninvestable. But it does mean you’ll want to size appropriately and be patient when building a position. Limit orders would be the best way to avoid creating a significant change in the stock price.

This idea might be more interesting for a personal account rather than a larger fund.