A Catalyst-Backed Net-Net

6x earnings. 60% discount to NCAV.

Key Metrics:

6x earnings

0.41x book value

60% discount to NCAV

Clear growth catalyst

Recently initiated dividend

Today’s stock is already cheap on its own. But what makes it truly interesting is a real catalyst. One that could accelerate revenue growth significantly. This makes it more than just a classic value investing opportunity.

Let’s dive in.

SMT Scharf AG (S188)

The company is called SMT Scharf AG (S188). It’s a German engineering business, founded in 1941, that specializes in rail-bound transport systems for underground mining and tunneling. Its core product is a monorail system, designed to move heavy materials and personnel through narrow, steep, and geologically challenging environments deep below the surface.

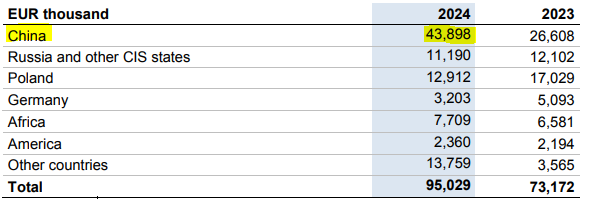

While SMT operates in a niche and manufactures in Germany, its reach is global. Key markets include China, Poland, Russia, and South Africa.

In short: SMT Scharf delivers highly specialized transport solutions for extreme underground conditions. Engineered in Germany and deployed around the world.

Now, let me walk you through the numbers.

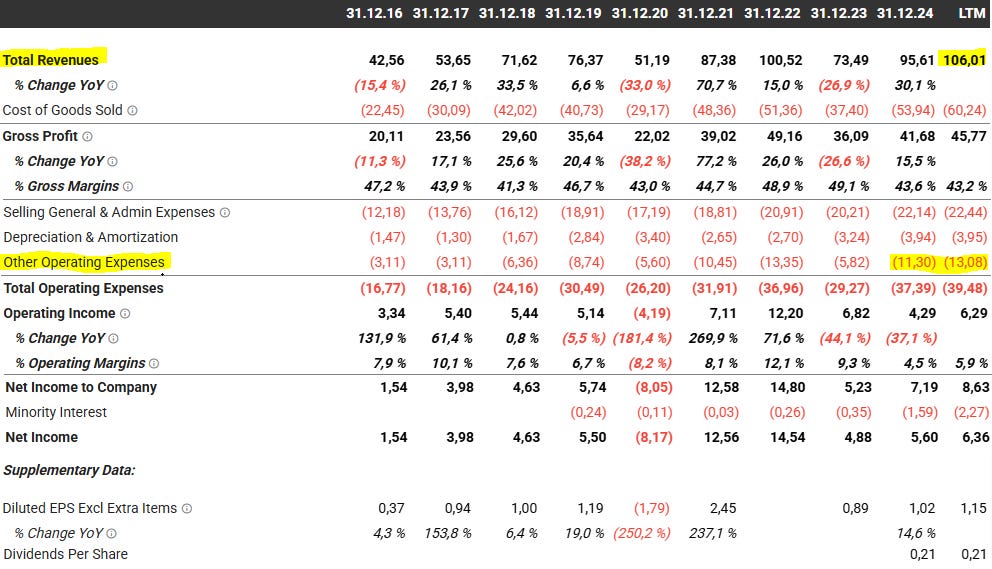

Income Statement

→ Income statement excerpts

As you can see by looking at the overall trend, revenue has been growing pretty steadily over the past decade. With 105.43M EUR in LTM, it’s currently at an all-time high. That’s especially notable considering SMT described the market conditions in 2024 as challenging:

„In the financial year 2024, the overall conditions in the market for mining equipment proved to be challenging“

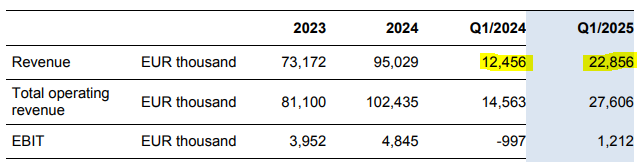

Quarterly earnings growth is even more impressive. In Q1 2025, revenue jumped 83.5% year over year.

Gross profit followed the overall revenue trend, though margins have tightened slightly.

Operating income, however, tells a different story. Margins have dropped a little bit, and operating profit even declined through the end of 2024. This can be largely attributed to a rise in “Other Operating Expenses”.

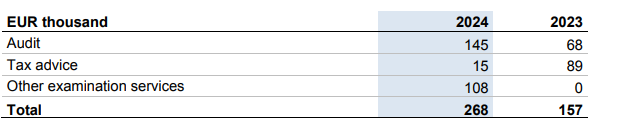

Most of these relate to third-party services, increased personnel costs, the rollout of a new ERP system, and higher auditing costs.

These expenses are primarily part of a broader shift in SMT’s company structure, which I’ll cover in the catalyst section.

For now, it’s important to understand that while these costs are putting pressure on current margins, they are temporary and should normalize once the transition phase is complete. The catalyst section will shed more light on this. But first, let’s get through the numbers, so we have a solid understanding of the fundamentals.

The rest of the income statement isn’t that interesting. They have some minor gains and losses from asset sales or hedging activity, but nothing unusual. Net income is pretty much in line with operating income, and came in at 6.36 million EUR.

At current prices, that puts SMT at just 6.07x earnings.

They also started to pay a small dividend recently, paying 21 cents per share. Nothing big, but still a nice signal.

So while the growth in revenue and the low earnings multiple are already nice to see, what stands out most here are the current operating expenses. Again, we’ll come back to that in a second.

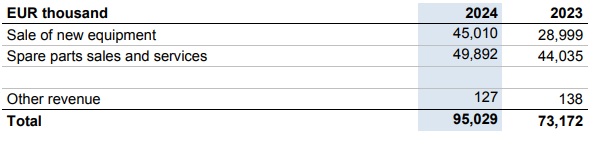

First, a quick look at where the revenue is coming from:

China remains by far the most important market, accounting for 41.5% of total revenue. In 2024 alone, that’s 43.9 million EUR out of 95 million EUR total.

As for business segments, 47% of revenue came from new equipment, and 53% from spare parts and services.

Other areas like tunnel logistics and general service also grew, but the core driver is the new equipment segment.

Now let’s take a look at SMT’s cash flow.

(Negative) Free Cash Flow

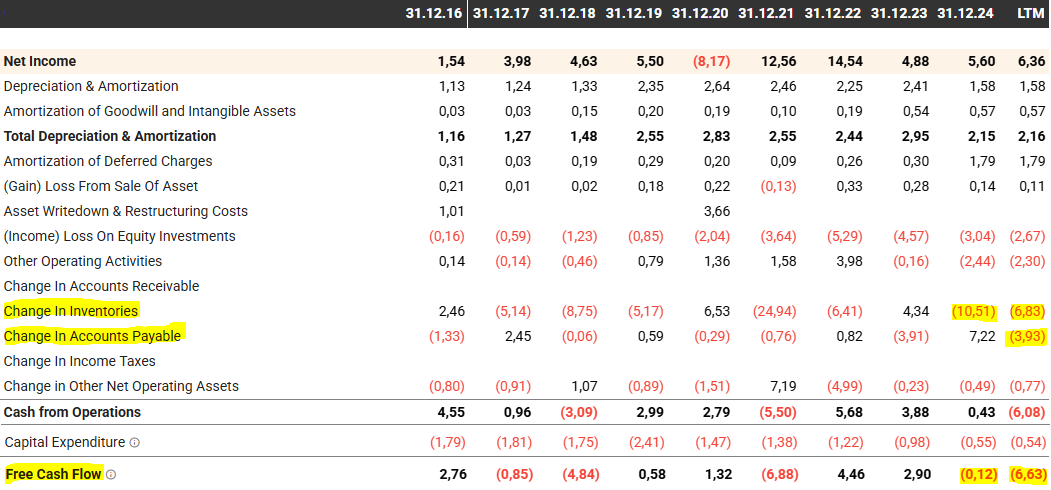

→ Cashflow excerpts

One thing that stands out is the negative free cash flow (FCF). At first glance, that’s not something you want to see, and it might raise some concern.

But a closer look shows there’s no reason to worry.

This might be a good a good moment to briefly explain what FCF actually is:

(To all experienced investors: Feel free to skip a few lines)

Free cash flow measures how much – you guessed it – real cash a company generates after covering its operating costs and necessary investments.

It’s often considered more meaningful than net income, since earnings can be skewed by accounting entries and tricks like depreciation, impairments, or goodwill.

Cash, on the other hand, is much harder to fake. That’s why many investors – like Michael Burry – focus on it.

So yes, many investors do prefer companies with consistently positive FCF. But the number alone doesn’t tell the full story. A negative FCF isn’t always a bad sign. In SMT’s case, it’s mostly due to two things:

a significant increase in inventory, and

a reduction in accounts payable.

Here’s what that means:

Inventory went up because SMT built up supplies and materials to reduce supply chain risk and prepare for growth.

Accounts payable went down because they paid off old supplier bills.

Both moves are good for long-term stability. But since they involve cash outflows, they appear as negative entries in the cash flow statement.

So even though the balance sheet shows more inventory, the cash flow statement shows a negative impact, because that cash is now sitting in stock, not the bank.

But SMT can afford this. The company holds a healthy cash reserve, so these outflows are strategic, not problematic.

To put it simply: cash left the business, but for the right reasons.

Some investors like to say, “You can only pay your bills with cash, not with net income.”

That’s true.

But in this case, the negative FCF is not a red flag, it’s a reflection of smart operating decisions made to strengthen the business.

And since SMT likely won’t need to build inventory at this level every year, it’s reasonable to expect free cash flow to normalize and turn positive again soon.

Balance Sheet

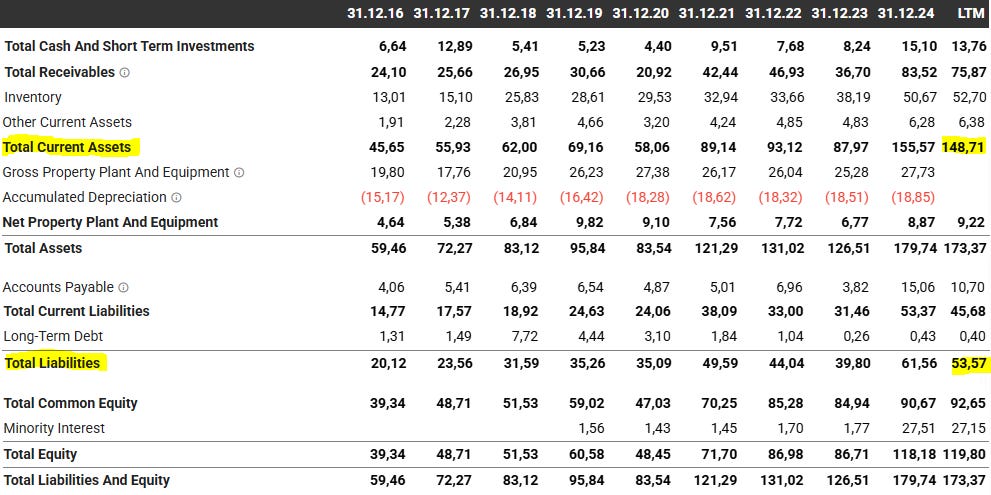

→ Balance sheet excerpts

SMT’s balance sheet looks solid. The company holds about one-third of its market cap in cash, has no goodwill, and carries very little long-term debt.

One number that really stands out is the Net Current Asset Value (NCAV).

With €13.76M in cash, €75.87M in receivables, and €52.7M in inventory, total current assets add up to around €148.71M. Subtract total liabilities of €53.57M and you get an NCAV of €96.01M.

Given a market cap of just €38M, that means SMT is currently trading at about a 60% discount to liquidation value.

Of course, NCAV isn’t the actual liquidation value of a business, but it’s still a helpful indicator. And a 60% discount is quite something!

Also worth noting: with total equity at €92.65M, the company trades at just 0.41x book value.

So after looking at the income statement, the balance sheet, and the current valuation multiples, one thing becomes clear: This stock is already cheap on fundamentals, especially considering the recent revenue growth.

But here’s where it gets even more interesting.

There’s a reason for the revenue spike. A change that should lead to even more growth going forward.

A catalyst that makes SMT an even more promising investment.

The Catalyst

There’s one thing that makes SMT stand out as a value investing opportunity:

The recent changes in the company structure.

I’ll try to explain it as clearly as possible.

Let me walk you through it.

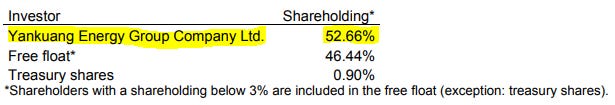

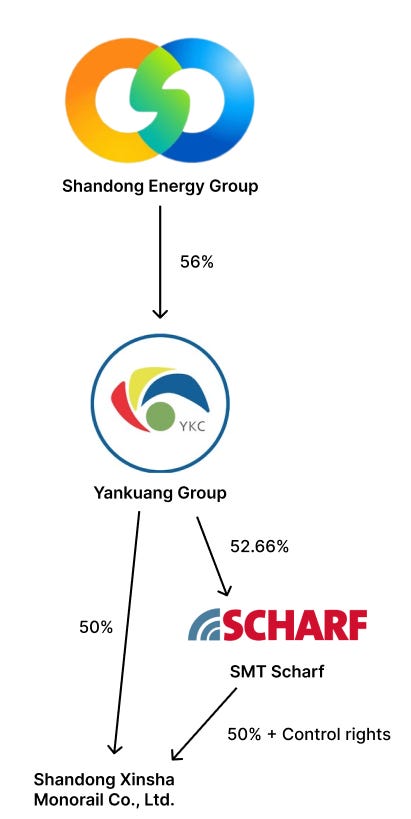

SMT Scharf is now part of a broader setup involving two key players: Xinsha and the Yankuang Group.

Xinsha is a Chinese company that develops and manufactures rail-bound transport systems for underground mining. So exactly what SMT specializes in.

It was founded in 2015 as a joint venture, 50% owned by SMT and 50% by the Yankuang Group.

Yankuang Energy Group is a major Chinese mining and energy company. It focuses on the extraction, processing, and trade of coal and energy, is publicly listed, and currently has a market cap of around $14 billion. (Interestingly, it also offers a dividend yield of 11%, which makes it an attractive investment in its own right.)

Yankuang, in turn, is part of the state-owned Shandong Energy Group. One of the largest coal producers in the world, generating more than $50 billion in annual revenue and employing over 100,000 people.

So, as you can probably tell by now, SMT is part of something much bigger.

This three-way structure – SMT, Xinsha, Yankuang – remained unchanged for about eight years.

But in 2023, SMT and Yankuang decided to deepen their cooperation. Their businesses aligned well, and they wanted to make collaboration easier and more efficient.

In 2024, they made two key moves:

First, SMT signed a formal agreement that gave them full operational control over Xinsha. Since Xinsha was previously 50% owned, it did not appear on SMT’s consolidated financials. But with SMT now in control, it must be fully consolidated going forward. That is one of the main reasons for the revenue jump starting in Q4 2024.

Here’s what the company said:

„The SMT Scharf Group generated consolidated revenue of EUR 95.0 million in the 2024 financial year. This corresponds to a significant revenue increase of 29.8% by comparison with the previous year (2023: EUR 73.2 million). The first-time consolidation of the joint venture company Shandong Xinsha Monorail Co., Ltd as from November was essentially responsible for the revenue rise and provided a significant boost to the new equipment business.“

The second move: Yankuang became the majority shareholder in SMT, now holding 52.66% of shares.

This makes working together much easier.

And there’s no indication that the new ownership will lead to negative changes. The board remains in place, and SMT keeps control over strategy and operations. In fact, SMT stated clearly:

“The new majority shareholder also supports SMT Scharf Group in pursuing its goal of expanding activities in the fields of mining and tunnel technology.“

Here’s an illustration showing the new structure:

Now, remember the rise in operating expenses we saw earlier?

Most of it is directly tied to this integration process. As these are one-time costs: coordination, consolidation, consulting, IT setup, legal reviews, audits, and ERP system rollout.

Since these expenses are mostly temporary, they should normalize once integration is complete. Some additional structural costs will remain, since SMT is now a larger company, but even then, they should settle at a much lower level than today. As a result, margins and profits should improve again.

Aside from that, the benefits of this new structure are substantial.

First, the full consolidation of Xinsha alone is a major catalyst. Xinsha has been included in SMT’s numbers only since November 1, 2024. From that point to year-end, Xinsha brought in EUR 15.9 million in revenue and EUR 3.4 million in profit. Half of that profit (EUR 1.7 million) was attributable to SMT.

Even more interesting: SMT noted that if Xinsha had been fully consolidated for the entire year, it would have contributed EUR 47.6 million in revenue and EUR 9.5 million in profit. Half of that would have belonged to SMT.

That’s pretty significant!

Here’s the original note from SMT:

„In the period from 1 November to 31 December 2024, the subsidiary generated sales revenue of EUR 15,888 thousand and contributed a profit of EUR 3,398 thousand to consolidated net income of which EUR 1,699 thousand was attributable to shareholders of SMT Scharf AG and EUR 1,699 thousand to non-controlling interests. If the company had been consolidated at the beginning of the reporting period, it would have contributed sales revenue of EUR 47.6 million and a profit of EUR 9.5 million to the consolidated net income, half of which would have been attributable to shareholders of SMT Scharf AG and half to non-controlling interests.“

With full-year consolidation in 2025, SMT expects revenue to jump to somewhere between EUR 110 million and EUR 130 million. Net income should also rise sharply. Even if Xinsha doesn’t grow further, SMT could see a profit contribution of around EUR 4.75 million.

Second, Yankuang didn’t go through all this effort just to be a passive shareholder. The goal is strategic cooperation. Since Yankuang operates many mining projects, SMT is now in a prime position to become a direct supplier for those operations.

“Yankuang has a strong presence in the Chinese coal mining industry. This opens up opportunities to achieve synergies in coal mining and unlock additional business potential in the Chinese market through close cooperation.”

And more broadly, SMT’s closer ties to a state-backed Chinese energy giant will likely make it much easier to do further business in China. Which, after all, is already SMT’s biggest market.

Final Thoughts

This is quite a special situation.

With the recent backing from one of the world’s largest mining groups, strong operational drivers, and meaningful upside, SMT is moving forward with great momentum.

The recent spike in operating costs has distorted the picture.

But that distortion is only temporary.

If you’re willing to wait just a little, you’re getting a business with global reach, solid fundamentals, and real earnings power at a price that’s already cheap on its own.

The newly introduced dividend signals confidence from management.

And given how small and underfollowed SMT is, it’s no surprise the market hasn’t fully caught on yet. (No wonder, it took me quite a while to piece everything together, too.)

But once you see the full picture, the setup becomes clear:

An already undervalued company that may actually be even cheaper than it looks.

With built-in growth potential and a powerful partner that wants to see it succeed.

Disclaimer: This content is for informational and educational purposes only and should not be considered investment advice. I’m just sharing my thoughts—not telling you what to do with your money. Some of what I write may turn out to be wrong. Always do your own research.

Any insight into why the stock price dropped so sharply mid 2023?

Investors often value companies with a strong dependence on China and Chinese owners at a discount. I think this is the reason for the low valuation.